We expect people to act in the future pretty much in line with the ways they’ve acted in the past. Your next-door neighbor will walk the dog at the same time every morning. Your spouse will always forget to put the cap on the toothpaste. One friend will generally be five minutes early, and the other five minutes late. As Mark Twain said, “the best predictor of future behavior is past behavior.”

Patterns and routines. The past predicting the future. We rely on it to make sense of the world and to move through it.

But when it comes to predicting financial behavior—for example, whether an individual will pay a credit card bill—relying on the past may not always be enough. Even with people who have years and years of exemplary payment histories.

Example: In 2012, we were asked by a major credit card issuer to look at charge-offs related to the Great Recession of 2008-2009. The results were astonishing, to say the least:

45% of individuals whose accounts were charged off had NEVER demonstrated any credit delinquency prior to the recession

For credit issuers, this should be extremely concerning. That’s because the ratings agencies place heavy emphasis on an individual’s past behavior when scoring future risk. For example, an individual’s payment history is about 35% of the total score at one of the major consumer credit scoring agencies. The length of their credit history is another 15%. In other words, historical behavior-based factors account for about half of their credit score.

But, when, as in our example above, consumers fall into sudden financial distress, there are no historical “risky” signals for models to pick up. Behavior-based models are flying blind in the face of major structural shifts.

It’s not that these models are bad. In fact, they work extremely well in steady-state situations, when we can reasonably expect that economic, social, and employment patterns will continue to hold from past to the present to the future. But—as we’ve seen in the Great Recession in 2008-9, the COVID-19 pandemic today, and myriad other recessions and industry- and location-specific downturns that have continuously occurred throughout history—models based on an assumption of a steady state become far less predictive when that ‘steady state’ is disrupted.

We believe that behavior-based models need an overlay that takes into account the impact of major structural,

environmental, and cyclical disruptions on individuals’ ability to pay their bills and meet their financial obligations.

This overlay is particularly critical now, as behavior-based models struggle—and largely fail—to take into account the massive structural disruptions caused by the global pandemic.

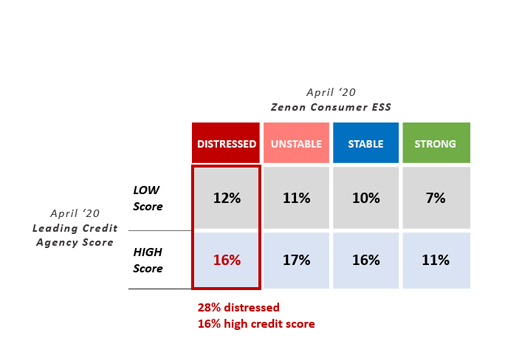

The chart below illustrates how much structural and environmental risk remains uncaptured by behavior-based models. This past April, we overlaid the Zenon Economic Stress Score (ESS), which measures structural and economic risk, on a portion of a consumer loan portfolio already scored by a major ratings agency. Overall, we found an that 28% percent of the sample was economically “distressed.” And of that group, 16% - well over half of all distressed consumers - had strong-to-excellent scores. In other words, our structural risk assessment was able to identify economically stressed customers that the score was not able to reveal.

FINDING HIDDEN STRUCTURAL RISKS:

ANALYSIS USING ZENON ECONOMIC STRESS SCORE

Sample of Major Lender’s Consumer Installment Loan Portfolio

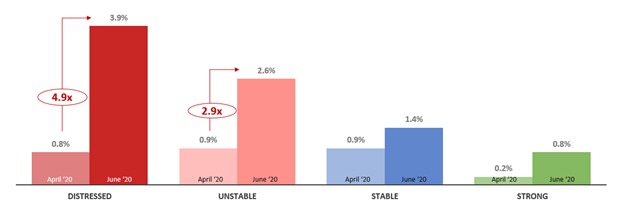

But were these consumers, in fact, really distressed? Well, in June, we looked at this same sample to see what had happened. And, in fact, the delinquency rate of the high-credit-score group we’d categorized as “distressed” had gone through the roof, jumping from 0.8% to 3.9%. No other segment’s delinquency rates came anywhere close. Structural risk analysis helped identify different set of risks that behavior-based models cannot see.

VALIDATION:

DELINQUENCY RATES TWO MONTHS AFTER INITIAL STRESS ASSESSMENT

Among Consumers with strong-to-excellent credit scores

So what goes into to a structural/environmental stress score? Factors that this overlay needs to consider include things like employment in vulnerable industry sectors, living in an area with a weakened local economy, and—specific to the pandemic raging today—COVID infection rates and how far along the local and state economies are with successful re-opening. Each individual needs to be scored on their exposure to structural and environmental factors that impact their personal financial situation, right here, right now.

These factors must be highly granular and specific to everyone’s situation. In the Great Recession, for example, someone who worked in the real estate industry or lived in an area where real estate was central to the economy was far more likely to be economically stressed than those working in less affected industries/geographies.

Today, in the face of the pandemic, the personal economic impact has likely been far more severe for someone working in a bricks-and-mortar retail store than for an employee at an online retailer. Similarly, a person living in an area where tourism is important will face stresses different from someone living where it’s not—and so on. Any structural risk assessment must be able to assess the situation at this level of granular detail.

The good news is that this detailed information is available on a continuous basis. Counties across the U.S. collect and make available up-to-date statistics on COVID infection rates, hospitalizations, and re-opening progress. Other sources provide information on different areas’ economies needed to assess localized exposure to disruptions. At Zenon, we have identified and sifted through more than 350 data sources to find the most valuable and high quality data to assess 30 million U.S. businesses on both their vulnerabilities and their growth opportunities vis-à-vis the pandemic.

Gathering and assessing this massive, granular information flow and being able to use it to assess millions of consumers is, of course, not a simple proposition. It takes both data handling and advanced machine learning to turn raw data into individualized structural and environmental risk scores and make it available in real time, on demand. Zenon has developed this capability to score consumers, and businesses, to support credit risk management, marketing suppression activities, and supply chain risk assessments.

In closing, we are clearly living in uncertain times, with enormous disruption that significantly inhibits the power of past behavior to predict future behavior. We need to incorporate the impact of this structural and environmental upheaval into existing risk, marketing, and supply chain management operations, right now. Traditional behavior-based models are not designed to account for these kinds of ongoing structural risks. Whether today in the midst of the pandemic or in tomorrow’s post-pandemic world, organizations will need an overlay to bring to light all the risk they cannot see.